Few concepts are as crucial to understanding Bitcoin as mining, mining is crucial to securing Bitcoin’s decentralized network and processing its transactions. But mining is not without its challenges—it requires significant resources, and profitability hinges on multiple factors like electricity costs, hardware, and the price of Bitcoin itself. This article breaks down the fundamentals of Bitcoin mining, how it works, and whether it’s still worth it today.

What Is Bitcoin Mining and How Does It Work?

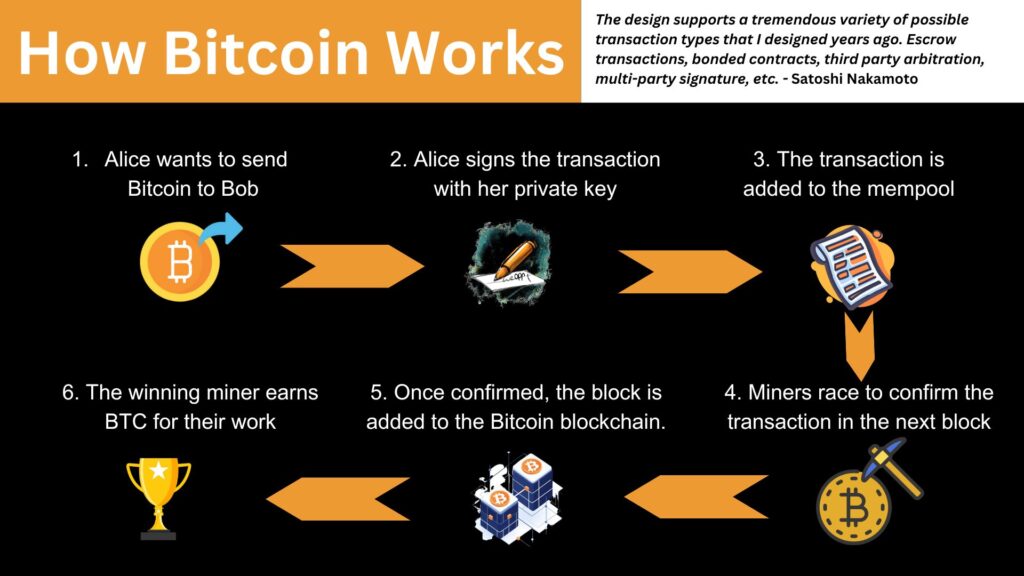

At its core, Bitcoin mining is the process of validating transactions and securing the Bitcoin network through cryptographic computations. Here’s a step-by-step breakdown:

- Transaction Creation: Bitcoin transactions are created when users send or receive Bitcoin.

- Broadcasting to the Network: Once created, the transaction is broadcast to the Bitcoin network, where it waits to be confirmed.

- Hash Puzzle Solving: Miners compete to solve a cryptographic puzzle. They do this by generating hashes (complex mathematical calculations) until they find a value lower than the target set by the network.

- Adding to the Blockchain: The first miner to solve the puzzle gets the right to add a block of transactions to the blockchain.

- Rewards and Fees: The winning miner receives a block reward in Bitcoin (currently 6.25 BTC) and the transaction fees associated with the validated block.

What is a Block Reward?

A block reward is the payment Bitcoin miners receive for successfully validating a new block of transactions and adding it to the blockchain. It consists of two components: the block subsidy and the transaction fees. The block subsidy is the fixed amount of Bitcoin awarded for mining a block, while transaction fees are collected from users who pay to have their transactions processed faster.

Currently, the block subsidy is 6.25 BTC per block, but this amount is designed to decrease over time through an event called the halving. Every 210,000 blocks (approximately every four years), the block subsidy is cut in half. The next halving, scheduled for 2024, will reduce the reward to 3.125 BTC per block.

Halvings ensure that Bitcoin’s supply remains limited, capping the total supply at 21 million BTC. While the halving reduces the subsidy, transaction fees can make up a larger portion of miners’ earnings over time, especially as the network grows and demand for transactions increases. This balance between block subsidy and transaction fees drives the long-term sustainability of Bitcoin mining.

What Are Mining Pools?

Mining Bitcoin on your own can be tough. Due to the massive competition and the high computational power required, solo miners face long odds in successfully solving a hash. This is where mining pools come in. A mining pool allows miners to pool their resources together, increasing their chances of earning Bitcoin.

In a mining pool:

- Miners combine their computing power to solve the hash puzzle faster.

- The rewards are split among pool members based on their contribution of computational power.

- This system allows smaller miners to participate in Bitcoin mining and earn a steady stream of rewards.

Popular mining pools include Slush Pool and AntPool, both of which are global leaders in Bitcoin mining.

Calculating Bitcoin Mining Profitability

The profitability of Bitcoin mining depends on several factors, including electricity costs, the price of Bitcoin, and the efficiency of mining equipment. Here’s a simplified look at the key factors involved:

- Equipment Costs: High-end ASIC (Application-Specific Integrated Circuit) miners are needed to compete. These can cost anywhere from $3,000 to $5,000 per unit.

- Electricity Costs: Mining is energy-intensive, so securing cheap electricity is vital. Miners often flock to areas with abundant renewable energy or inexpensive electricity, such as Texas.

- Bitcoin Rewards: Miners earn Bitcoin for validating transactions. As of now, the reward is 6.25 BTC per block, but this reward will halve approximately every four years.

Let’s consider the latest Bitmain Antminer S21, which boasts a hashrate of 234 terahashes per second (TH/s) and consumes 3,500 watts of power. Using the U.S. average electricity cost of $0.177 per kWh, we can estimate the potential earnings and costs according to CryptoGlobe’s Profitability Calculator.

Based on this setup, a miner could expect a daily profit of $9.93 after accounting for electricity and pool fees, which totals approximately $297.99 per month. However, this assumes stable Bitcoin prices and network difficulty. The key takeaway is that electricity costs significantly impact profitability. As shown, electricity expenses amount to $446.04 per month, meaning that miners in regions with cheaper power—such as those utilizing renewable energy—will have a significant edge.

In conclusion, while Bitcoin mining can still be profitable with the latest hardware, it’s only truly worthwhile if you have access to low-cost energy. For miners paying higher electricity rates, profitability could be slim or non-existent.

A History of Bitcoin Mining

Bitcoin mining has evolved significantly since the cryptocurrency’s inception in 2009. Here’s a brief timeline:

- 2009: Bitcoin mining began with Satoshi Nakamoto’s first block (the Genesis Block), mined on a basic home computer.

- 2010-2012: As Bitcoin’s popularity grew, early miners used CPUs and GPUs to mine Bitcoin. Mining became competitive, and the first mining pools were established.

- 2013-2017: The introduction of specialized hardware, called ASICs, revolutionized the industry. ASIC miners are far more efficient than CPUs or GPUs, making home-based mining less practical.

- 2021: China banned Bitcoin mining, causing a massive exodus of miners to North America and other regions. This migration led to the growth of industrial-scale mining operations, especially in Texas.

- 2023 and Beyond: As Bitcoin’s hash rate continues to rise, mining is becoming more competitive. New technologies and renewable energy sources are helping to make Bitcoin mining more efficient and sustainable.

Bitcoin mining